In now’s speedy-paced and unpredictable small business setting—Particularly throughout the assorted marketplaces of the center East and Africa—getting access to accurate, trustworthy, and timely information regarding the businesses you are doing business with is no more optional. Enterprise Credit history Experiences have become A necessary Software for enterprises looking to manage credit history hazard correctly, stay clear of highly-priced defaults, and make knowledgeable decisions.

one. Make Assured Credit rating Choices with Trustworthy Data

An extensive business credit history report gives an in-depth overview of a company’s economic steadiness, operational historical past, payment actions, and legal standing. Using this info at your fingertips, your workforce can:

Evaluate creditworthiness ahead of extending conditions or supplying financing

Detect crimson flags like late payments, authorized disputes, or deteriorating financials

Mitigate hazard by customizing credit limitations and phrases for every customer or provider

This is particularly important inside the MEA location, in which publicly out there economical details is usually limited or inconsistent.

2. Enrich Danger Management Throughout Borders

Undertaking business throughout a number of nations around the world in the center East and Africa usually means coping with various regulatory techniques, levels of transparency, and financial ailments. Business credit reports offer you a standardized hazard profile, helping you to definitely:

Review corporations throughout markets using dependable credit score scoring

Fully grasp area context, such as variations in small business rules or country chance

Create a regional credit rating plan determined by real knowledge as opposed to assumptions

3. Guard Your enterprise from Payment Defaults

On the list of prime explanations businesses experience cash movement troubles is due to delayed or unpaid invoices. Organization credit score reviews assist decrease this danger by providing:

Payment background insights, demonstrating how immediately a business pays its suppliers

Credit rating score traits, indicating improving or worsening habits with time

Alerts and updates, and that means you’re informed of any considerable modifications that will impact payment trustworthiness

Becoming proactive, in lieu Company Credit Report of reactive, allows you stay away from unnecessary losses and sustain a nutritious equilibrium sheet.

four. Streamline Onboarding and Research

When bringing on new purchasers, associates, or suppliers, a firm credit score report simplifies and accelerates your due diligence method. With only one document, you'll be able to overview:

Organization registration and possession construction

Important monetary ratios and once-a-year turnover

Bankruptcy information, lawful judgments, and regulatory flags

This hurries up decision-creating whilst ensuring compliance with internal danger insurance policies and external polices such as anti-revenue laundering (AML) criteria.

5. Strengthen Negotiating Electricity and Strategic Organizing

A transparent idea of your counterpart’s economic wellbeing provides you with leverage in negotiations. It is possible to:

Adjust payment phrases, such as necessitating progress payment or shorter credit score cycles

System for contingencies, by pinpointing suppliers or consumers who may well existing risk

Prioritize partnerships with firms which might be economically steady and low chance

During the MEA area, in which financial shifts can occur promptly, this foresight is very important to protecting your company pursuits.

6. Assist Portfolio Monitoring and Reporting

Should you’re running a sizable portfolio of customers, vendors, or borrowers, maintaining keep track of of every entity’s credit overall health generally is a major challenge. Firm credit rating experiences enable you to:

Watch modifications eventually with periodic updates

Phase your portfolio by threat stage, field, or geography

Create actionable insights for inside reporting or board-stage discussions

This allows for far better strategic scheduling, compliance reporting, and General credit danger governance.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Susan Dey Then & Now!

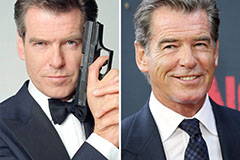

Susan Dey Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!